InvestorBook is the always-on investor relations platform for private businesses. InvestorBook keeps financials, decks, and dashboards polished, relevant and current — so when capital raises or exits are desired, management teams are always ready, without disruption.

When an investor or buyer comes calling, or a financing/exit initiative is desired, most private companies scramble. Financials aren’t clean, reports aren’t professional, and the story isn’t ready. This creates stress, delays, distractions and ultimately weaker negotiating positions.

Weeks wasted formatting decks and reports.

Version control chaos across email, SharePoint & Dropbox.

Inconsistent KPIs and messy financials.

No single source of truth for investors and boards.

All-consuming process to gather information for capital raises or exits.

No standardization across investor portfolio companies.

No self-directed access to relevant, timely information without interrupting management.

No continuous valuations or ability to test the capital markets for financing alternatives.

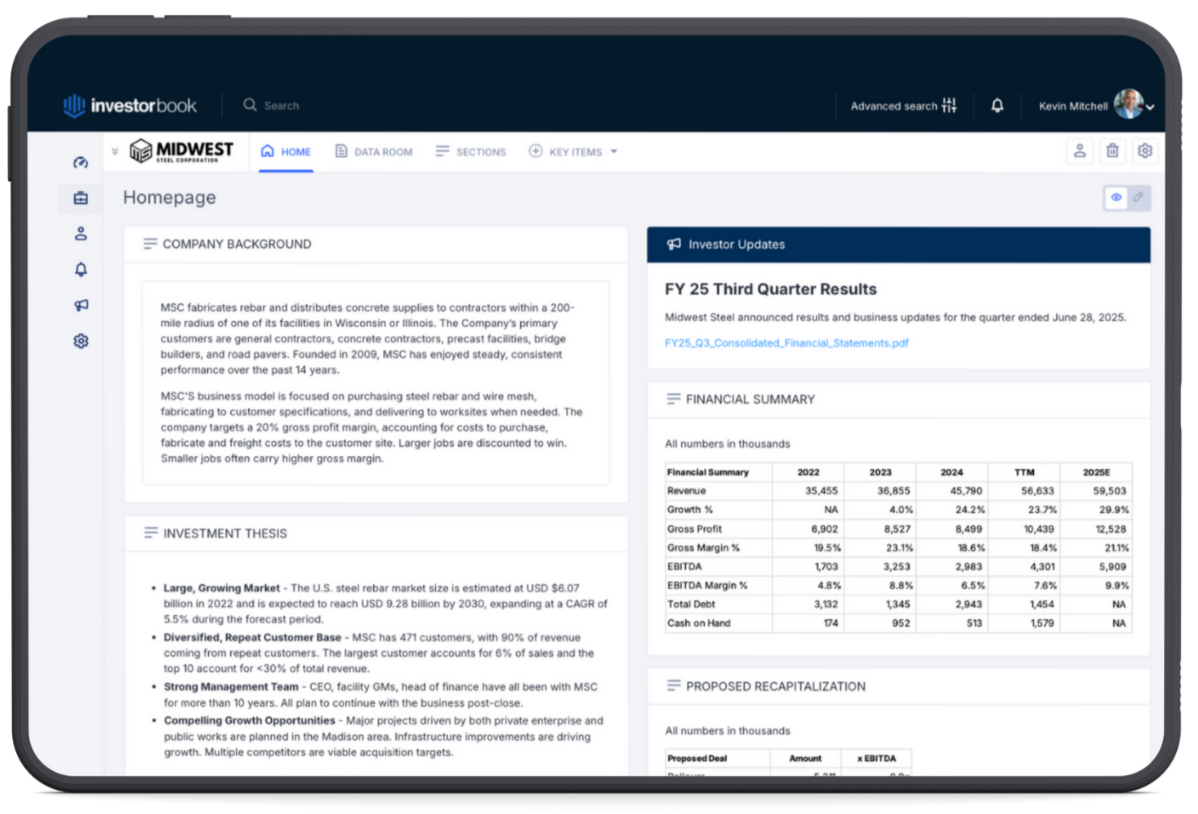

InvestorBook keeps your business investor-ready, continuously. We centralize financials, build investor-grade reports, and maintain a digital company profile that tells your story the way investors and buyers want to see it. No scramble. No chaos. Just clarity, credibility, and control.

We build your institutional-grade portal once, then keep it current every quarter. It's like a dynamic CIM. Materials are best-in-class and will impress investors, Boards and owners. No more reinventing the wheel each time a new report or meeting comes around.

Updates tailored for every audience. From strategic updates to covenant reporting, we adjust the same core materials so you’re always speaking the right language to the right stakeholders.

Free your CFO from busywork so they can focus on performance. Instead of pulling late nights in PowerPoint, your team spends time driving results — while still delivering relevant, polished information that reflect well on leadership.

When the day comes, you’re already 90% prepared for a smooth capital raise or sale process. Invite an investment banker if you wish, and they'll be ecstatic by your preparedness. By keeping materials current and consistent, you’re not scrambling to pull together a Confidential Information Memorandum (CIM) or assemble a data room; you’ve been building one all along.

![[interface] screenshot of core features (for a ai legal tech company)](https://cdn.prod.website-files.com/image-generation-assets/d77c0669-7ba2-4bd5-a924-e306a10b7ebc.avif)

No more scattered emails, or version-control nightmares. All relevant information is centralized in a single portal for your stakeholders to view 24/7. Everyone is working from the same playbook, from cap tables to valuations, to financial updates and Board decks, it's all there.

With 28 years in investment banking, private equity, and as a 3-time CEO, Kevin Mitchell has been on every side of the table. InvestorBook was born to solve the pain CFOs feel — messy reporting, wasted prep time, and loss of credibility in front of investors.

Kevin has been party to more than $2bn of transactions over the last three decades, as a sell-side M&A Advisor, institutional investor, family office investor and operator. He's navigated around the same problem his entire career and felt it was time to create a solution that helps operators bring relevant information to the forefront, gain alignment with investors, boards and service providers, and make their ability to raise capital and sell their companies ten times easier.

Investor-ready presentation.

Central source of truth.

Higher trust & better relationships.

Liquidity optionality & value capture.

IR PORTAL

$0/month

Your free always-on portal to manage owner & lender communications

Includes:

Upload key financials & documents once

Less than 30 minute intake form

Virtual data room

Dashboard with salient "investor" information

Secure sharing with investors, lenders, and advisors

Email support

PROFESSIONAL

$5k/month

For companies that need high-quality investor relations or are preparing an exit

Everything in PORTAL, plus:

Refreshed Monthly

Databook

Financial Model

Investor Updates

Refreshed Quarterly

Confidential Information Memorandum

Board Presentation

Monthly video call

* Professional Plan requires 6-Month Minimum Commitment

ADVISORY

Contact Us

When you're ready to sell, we provide full-service M&A advisory to maximize value

Everything in prOFESSIONAL, plus:

Buyer list generation

Targeted outreach to qualified parties

Coordination of information requests

Negotiation and structuring support

Full process management from initial Teaser to final Closing

Weekly update call